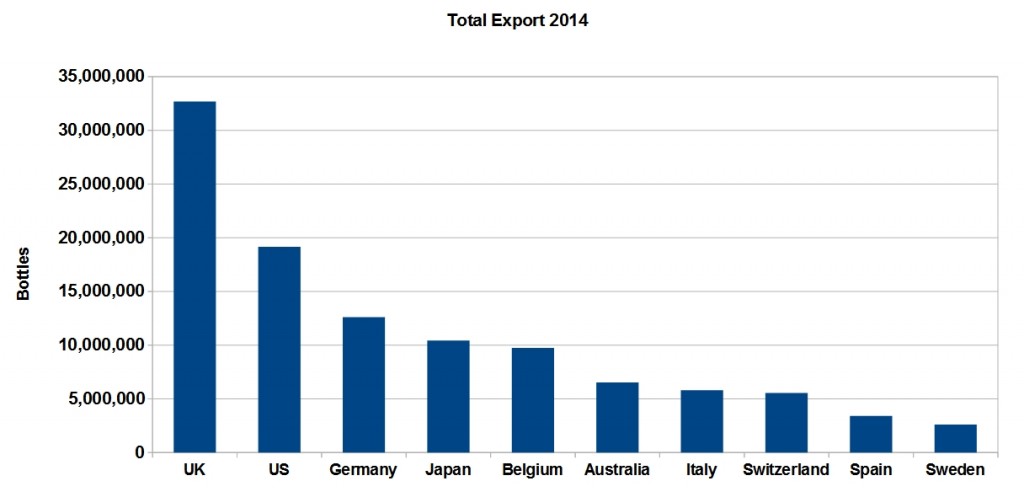

Just a few observations on Champagne Export statistics. Here we have graphs showing different perspectives. You can click on the graphs for a larger popup version. First, the total bottle statistics for top ten counties.

Here we have the total volumes shipped with Australia coming 6th in total volume. Italy and Spain are still in some financial difficulties and have slipped behind Australia. Belgium is huge for its population of only 11,000,000 and this would not include the number of bottles bought by the ‘weekend Champagne tourist’. It is only a half day drive to the Champagne region from Belgium and they stock up big time with these statistics being recorded as an ‘in France’ sale. Also German and Italian tourists would stock up also. Japan’s consumption is quite miserly given their population of 127 million. Average per capita wine consumption for Japan is 2.6 litres compared to Belgium’s 26 – yes the Belgians drink 10 times more. This would imply that Japan has terrific future market expansion potential.

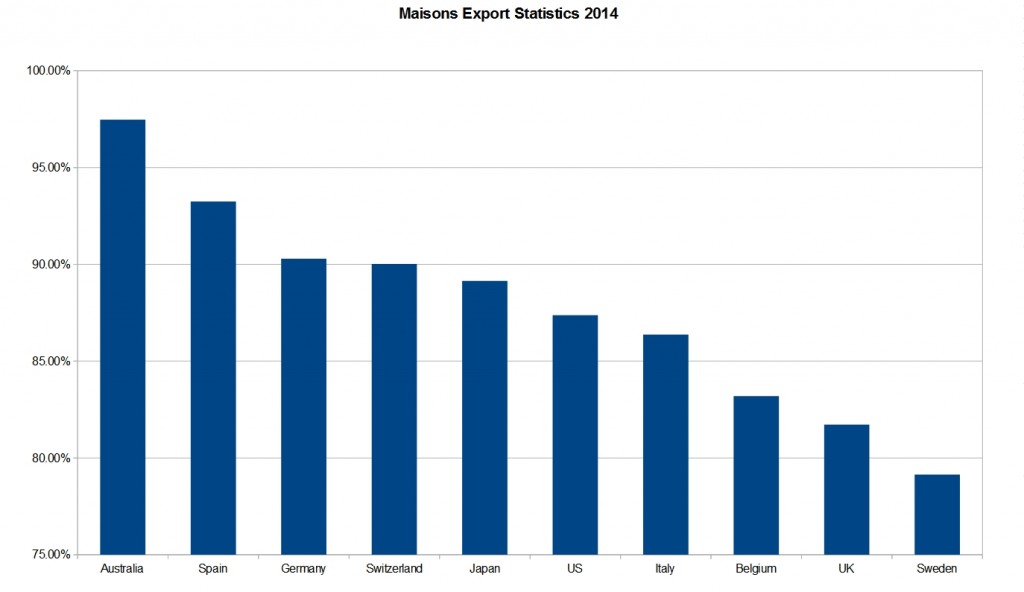

Next we have Percentage statistics for the ‘Maisons’. This is percent of total country volume.

It is interesting to see that the big house penetration into the Australian market is quite definitive and impressive. Supermarket depth in Australia is huge with Woolworths operating more than 1300 liquor outlets and Coles maybe 1000. Woolworths Group includes Dan Murphy, BWS, Langtons and Cellarmasters. Woolworths import Champagne Lanson and some other lower quality Champagnes. Coles own Liquorland, Vintage Cellars and 1st Choice and import one important big grower Champagne, Gimonnet and other smaller marques. Sadly because Gimonnet is seen as a super market brand, it is seldomly seen in any restaurants or wine bars across Australia.

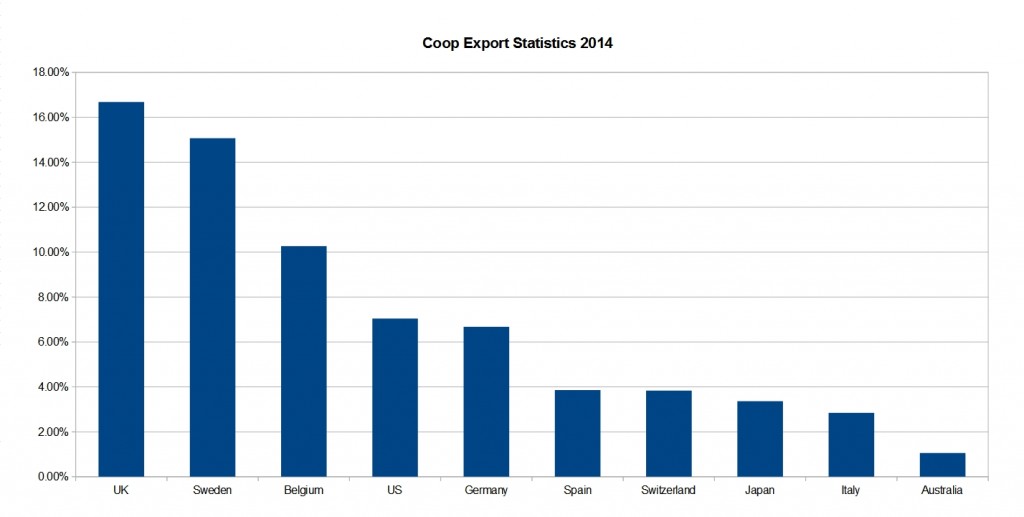

Next we have the Co-operative statistics as a % of total country volume. Huge in the UK with many supermarkets re-branding Co-op labels. Totally miserly in Australia. ‘Co-op’ appears to be a no-no in Australia.

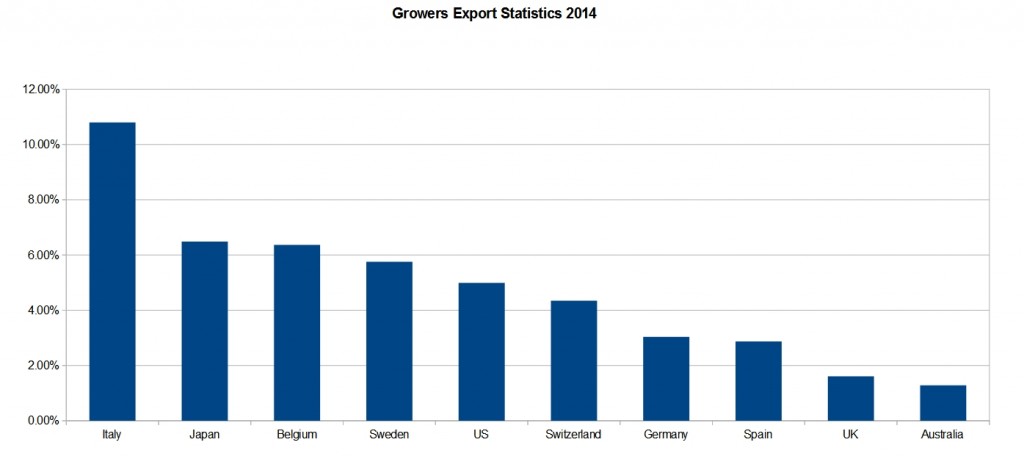

Next we have the grower figures as a percentage of total country volume.

Australia and UK are way last and it is difficult to explain why. The most likely explanation would be the proliferation of Supermarket. Both countries have similar drinking statistics, inflation rates and unemployment figures and a huge dominance by two Supermarket chains. In the UK the supermarkets push the maison and co-op brands, whereas in Australia they focus primarily on maison brands. Certainly the top end restaurants Australia wide are searching for the niche natural/organic/biodynamic Champagnes and hence are becoming homogeneous in range and very fussy in their selection. Everyone wants Selosse! Also for UK market their is the ‘in France’ tourist purchase – maybe in Calais or Champagne region, this would skew the statistics. Same applies for Belgium, Italy, Germany and Spain.

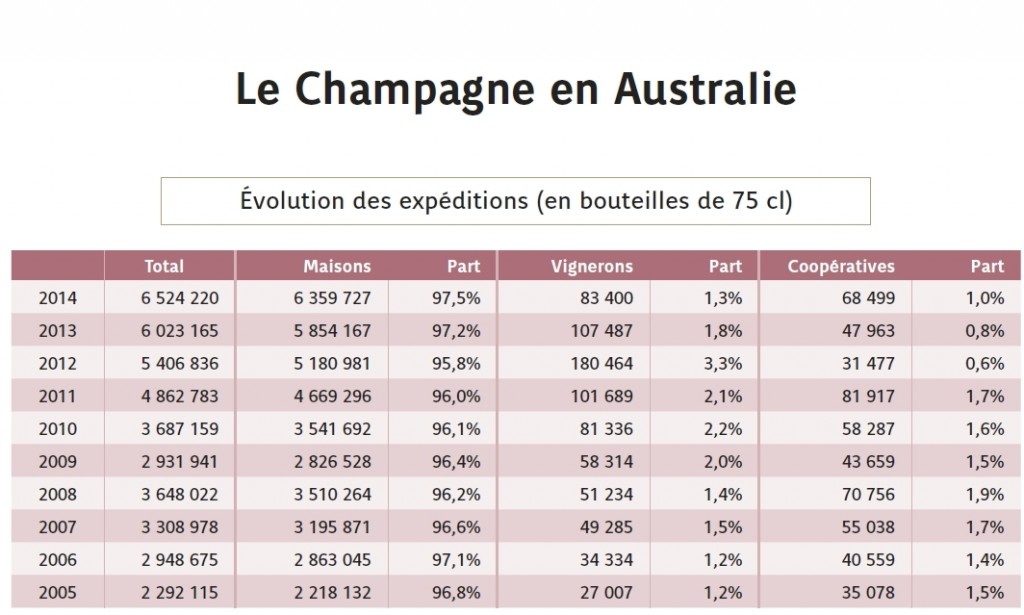

The Australian market

This table is quite indicative of the power of the maisons in Australia – courtesy CIVC.

Maisons have experienced some real growth since 2005. Cooperatives are doing very little and the Vignerons are back to 2006 levels as a percentage. Why? The big houses can discount. Customers understand what a ‘Luxury Brand’ means. And at the moment – a ‘Luxury Brand’ does not mean a grower Champagne to most people. Sure the fine wine aficionado understands a grower Champagne, but that is still a tiny minority. The top restaurants all chase the leading organic/biodynamic trending grower Champagnes. Then we see ‘terroir expressive’ Champagnes also being keenly chased. So names like Egly-Ouriet, Selosse, Agrapart, Larmandier-Bernier, Chartogne-Taillet, Vouette et Sorbe, Cedric Bouchard, Eric Rodez, Prevost, Peters, Tarlant, Boulard, Bereche, Lassaigne and a few others have a strong following, and these twenty or so names have been in the lime light for the last ten years at least. But if the grower Champagne is simply nice, pleasant, fault free – it appears not to be destined for long term success. A grower Champagne has to have a ‘real definitive edge’ to be noticed and become a sustainable alternative to a big house brand. It needs to be ‘terroir indicative’, organic/bio-dynamic, natural etc. to have a hope of cracking into the top echelon. Or maybe hope that a supermarket picks you up and spreads you across 1,000 stores – never to be seen in restaurants or wine bars.

107 vignerons account for 83,400 bottles. The NM producers would be part of the Maisons statistics so Veuve Fourny and other ‘small grower family and friends NM’ would be in the Maisons. I estimate that the top 17 growers would account for about 30,000 bottles, so the remaining 90 growers would be after the remaining 53,000 bottles. Approximately one pallet for each grower. It is a tough market. There are very few online merchants that specialise in only grower Champagnes. And there would be 30 growers in the statistics selling to private customers.

With such a lack lustre penetration into the Australian market by some grower Champagnes one can see some sense in the growers chasing after newer and potentially more lucrative markets. Japan has potential and of course China.

This final graph shows total grower volumes for top ten countries. Japan, Italy and Belgium are huge in comparison to Australia.

So what helps getting a grower Champagne into the Australian market?

Depends which market layer the grower is aiming for. For the top restaurant and wine bar market, sustainable/organic/bio-dynamic with a really good terroir story is obligatory. Champagne at this level has to be a ‘wine’ first, and hence it can be easily matched to a restaurant menu. This market can support different price points but the nature of the wine-making means it will not be cheap – organic/bio-dynamic is more expensive to produce.

For penetration into a lower market layer, price is very important along with clear simple and recognizable labeling. Australia is a big country and distribution of a delicate product like Champagne can be tricky. So a grower can hope to find an Australia wide importer (a tricky area) or work with a number of smaller importers on a state by state basis.

There is a lot of relevant discussion about corked wines, natural cork, diam cork etc. Also much talk about dosage levels, back label detail, disgorging dates etc, which are all extremely relevant to any fine wine aficionado, or even to someone moderately interested in wine. I have been to a few tastings recently (where there were many aficionados) where no-one looked or cared at corks or disgorgement dates. So I think that 99% of consumers buying Champagne actually don’t care and find this more confusing and hindering than helping. Sad but reality. Price appears to prevail. The majority of consumers idea of an aperitif ‘fizz’ to have before a meal is very price chosen.

There has been a recent resurgence of independent fine wine liquor stores in Australia, and maybe these will expand their selection of grower Champagnes. We have to wait and see. Also we need more direct online merchants who not only carry a good range of grower Champagnes but also do tastings/education/masterclasses etc.

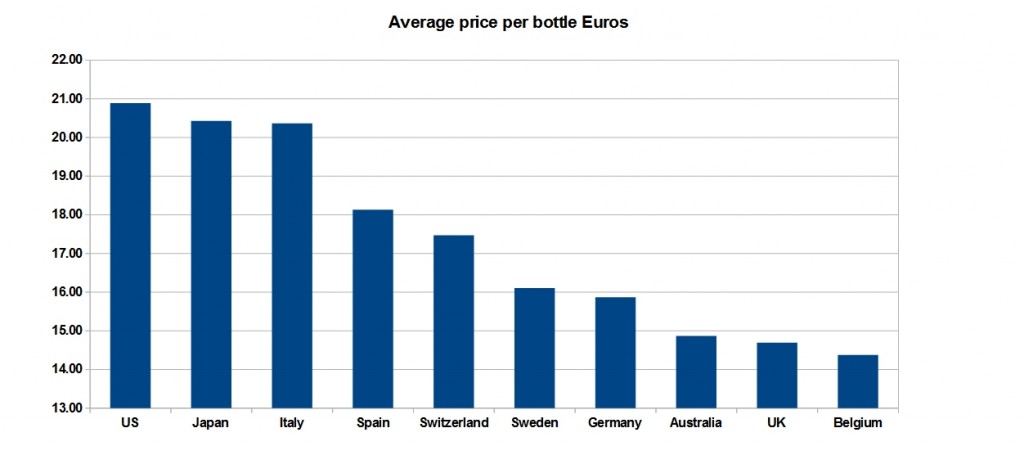

Finally this graph shows the average Champagne price per bottle for the imports into each country. Japan and US are hungry for premium Champagne!